No Loss Forex Hedging Strategy

This forex hedging strategy will teach you how to trade the market's direction. No loss forex hedging strategy can be valuable to reduce risk, but they can not represent any no loss strategies for forex trading.

Forex Hedging Martingale Strategy Robot Forex Ea News Trader

Now, we’re going to show you one forex hedging strategy that uses multiple currencies to hedge.

No loss forex hedging strategy. To get the complete guide, download the pdf here: This can be usable for short time and also for long timeframe.this is also called a perfect hedge. Best account for this strategy click on open account.

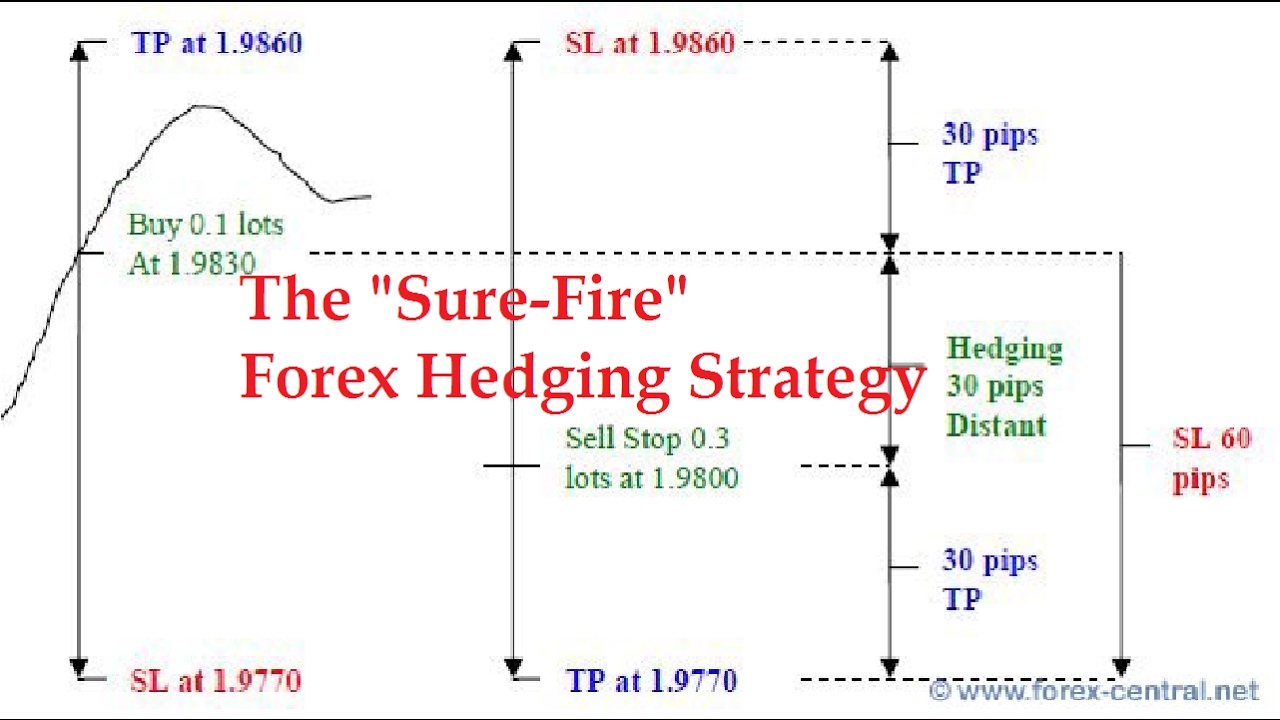

Does one end up able to deal any sort of process and approach you would like on the $10000 bank account together with switch just about every deal people get to a get deal (of $200 and $20) or maybe a breakeven deal and get only one small to medium sized theoretical chance for dropping say $600 with most detrimental condition circumstances? This is known as a no loss forex hedging strategy in which no costs are associated. Traders, as well as forex robots, deploy the short term protection strategy whenever there is concern that news or upcoming events would lead to adverse events that could trigger losses on an open position.

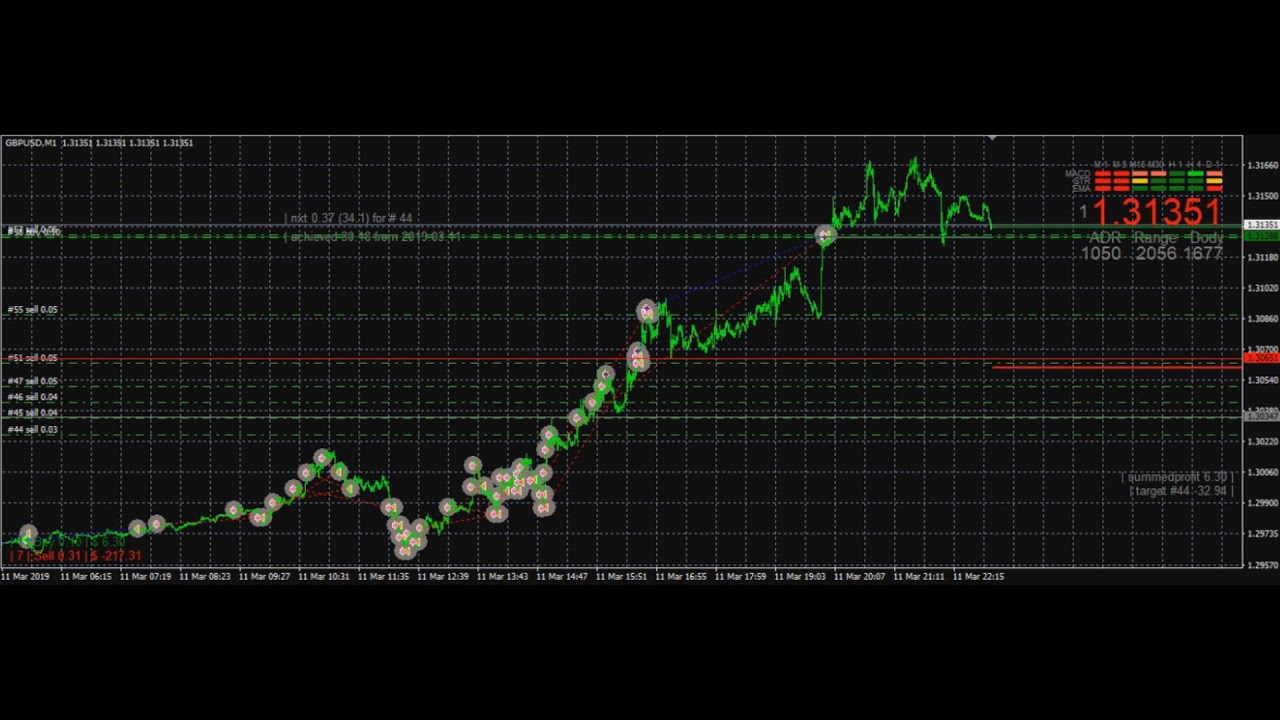

Its just an idea that if you know how to code an mt4 expert advisor, you can follow the trading rules below and see if its profitable in the long term or not. Is there a guaranteed no loss forex hedging strategy where you can take positions with the intention of achieving profit, but also mitigating your risk simultaneously? For example, a trader can open a long gbp/usd, usd/jpy.

Pair hedging is a strategy which trades correlated instruments in different directions. Whilst, unfortunately, it is not possible to completely remove all risk, there are a vast number of different forex hedging strategies that aim to do this to varying degrees. Forex hedging is a method which involves opening new positions in the market in order to reduce risk exposure to currency movements.

However, if you want to get around the fifo rule you can use multiple currencies to hedge your transactions. There are many cases when usually correlated currencies and commodities diverge from each other because of the latest economic announcements or other factors. Another method of hedging in the forex market or any other financial market is to use derivatives such as options contracts.

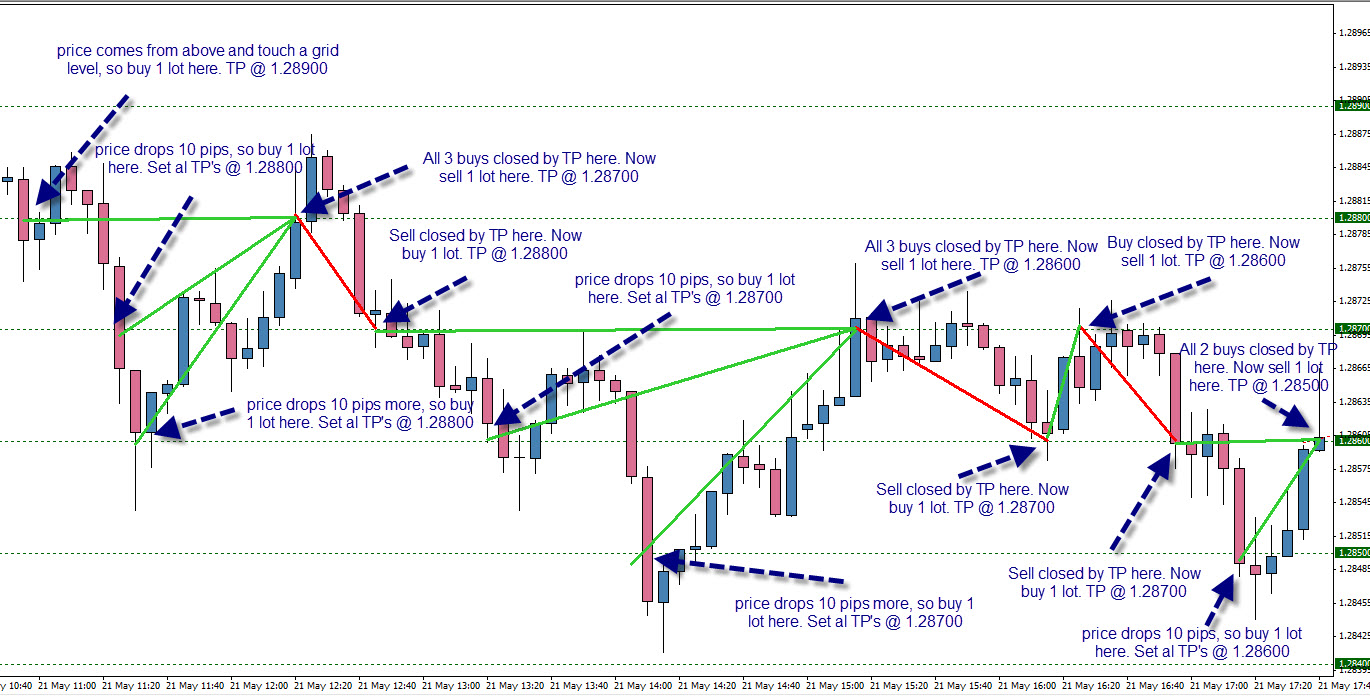

It is additionally used to distinguish the specific purchase and sell signals in the market pattern. Nowadays, the first method usually involves the opening positions on 3 currency pairs, taking one long and one short position for each currency. This is done to even out the return profile.

No loss forex hedging strategy pdf 2021. 100% win no loss my own forex trading strategy in urdu and hindi by tani forex. There are various employments of this methodology which helps the brokers in a gainful trade.

In the forex hedging strategy the trader can save his currency from wrong move by creating hedges in the chart. Learning the basics of forex trading is the logical start. No doubt that the hedging is a unique idea in the market trading.

October 11, 2020 at 2:45 am remember to like, share videos, subscribe and encourage others to #subscribe — it's all i am asking in return. You just need to know at what time the market moves enough to get the pip profit you want. The advanced forex hedging strategy plays very important role to manage risk in the market trading.

Hedging is amongst the most utilized strategies to reduce and manage risk. Hedging was banned in 2009 by cftc. Scalping with no loss +30 days free signals (except commission) detailed step by step video guide on how to use the system and how to hedge all your trades out to lose only commission.

These no loss forex hedging strategy are plotted between the upper and lower levels, which imply that the forex hedging strategy. If you follow all points of this strategy never loss. 100% win no loss strategy work on 12 different pairs.

Trading without a stop loss is really dangerous in my opinion so do not try this no stop loss forex system with a live trading account. This is simply not available to independent traders in other markets. It protects traders from risks.

It replaces the usual stop loss and acts as a guarantee of profits. The path to success means that you never stop learning. No loss forex hedging strategy with pdf.

Forex hedging is, therefore, the process of trying to offset the risk of. If you want to use a forex hedging strategy with a us forex broker, it’s not possible. This is a no stop loss forex trading strategy.

The hedges of the forex strategy protects the traders from the risks factors. This system is accessible for all the traders and it is additional material for transient trade and long haul trade. This strategy is a cinch to undertake, in that it only requires one to open a position going opposite to one’s current position.

Option hedging limits downside risk by the use of call or put options. Follow up support to make sure you are fully efficient to use the trading system a and system b to scalp and hedge out your trades on your own with full confidence, assurance and certainty on the live forex charts. In this tutorial information about no deposit bonus hedging secret strategy.

So you still take a loss from your losing trades, but you do it at a net profit. Forex trading is a very risky business. When the price moves in the market, in most cases there is a possibility of hit stop loss.

Options contracts are recognized as one of the most popular derivatives and excellent tools in different markets. The concept of a perfect forex strategy is somewhat captivating. No loss forex hedging strategy pdf.

In this trading strategy if you follow all points, this is very easy for you that you recover your all loss in few days. 2 accounts, hedging way, no loss, 100% profitable trick. Types of the hedging strategy at the point when the value breaks at the upper level then it is an ideal opportunity to purchase and when the value developments break on the lower level then it is an ideal opportunity to sell.

This is the core of my forex hedging strategy and this one idea alone is very powerful. Let’s take a look at the simplest strategies that traders employ. Hedging is a popular trading strategy deployed to protect opened positions in the forex market from adverse events.

First remember in mind first work 15 to 30 day on demo account. It terminates all risk chances and increases the power of profit.the hedges. Tani forex trading secret hedging strategy tutorial in hindi and urdu by tani forex.

So trading from not being secure can cause a lot of problems. @ there are essentially 3 popular hedging strategies for forex. However, i would say that it is better to use the strategy that you are satisfied with.

This is as near to a perfect hedge as you can get, but it comes at a price as is explained.

No Indicators Trading Strategy (NITS) Weekly Report 24

No Indicators Trading Strategy (NITS) Weekly Report 24

6 Best Powerful Forex Strategy For Consistent Profits (2021)

6 Best Powerful Forex Strategy For Consistent Profits (2021)

Forex Risk Hedging Forex Casino System

Forex Risk Hedging Forex Casino System

Forex Hedging Techniques V Save Fx Trading

Forex Hedging Techniques V Save Fx Trading

Forex strategy no stop loss Trading System Signal Scalping

Forex strategy no stop loss Trading System Signal Scalping

Forex Hedge Trading Strategy No loss YouTube

Forex Hedge Trading Strategy No loss YouTube

Forex Trading Hedging Strategies Forex 4h Trading System

Forex Trading Hedging Strategies Forex 4h Trading System

No Loss Forex Hedging Strategy Forex Trading Memes

No Loss Forex Hedging Strategy Forex Trading Memes

Forex Trading Without Stop Loss Forex Scalper Signals

Forex Trading Without Stop Loss Forex Scalper Signals

Hedging Forex Opiniones Forex Fury Robot Nation

No Loss Hedge Method with Super Hedge EA 2020 Best Forex

No Loss Hedge Method with Super Hedge EA 2020 Best Forex

Is This The Best Forex Trading Strategy EVER? Live Trading

Is This The Best Forex Trading Strategy EVER? Live Trading

No Loss Forex Strategy with Renko Charts YouTube

No Loss Forex Strategy with Renko Charts YouTube

No Indicators Trading Strategy (NITS) Weekly Report 13

No Indicators Trading Strategy (NITS) Weekly Report 13

Universal grid Forex EXPERT ADVISOR EA no loss hedge

Universal grid Forex EXPERT ADVISOR EA no loss hedge

No Loss Forex Hedging Strategy Pdf

No Loss Forex Hedging Strategy Pdf

Comments

Post a Comment