Forex Pattern

5# the symmetrical triangle strategy. The example below of the eur/usd (euro/u.s.

Forex Triangle Pattern Lena Patterns

Forex Triangle Pattern Lena Patterns

After a prolonged uptrend marked by an ascending trendline between a and b, the eur/usd temporarily consolidated, unable to form a new high or fall.

Forex pattern. Quasimodo pattern does not appear all the time, but when this happens, traders should not ignore it. Unlike other forex chart patterns, harmonics are challenging to spot and draw, as we are talking about geometric figures.secondly, they consist of a list of conditions required before the pattern can be considered as active and tradeable. This is a best indicator like others who can be optimistic and multi time frames for mt4 trading which can be start from …

Pattern recognition master download related metatrader indicators:download better volume 2.1 indicator for mt4 freedownload rsi filter indicator for forex mt4 freedownload harmonic pattern detection indicator for mt4 free123 patterns v7 indicator for mt4 free downloadbest sma crossover signal indicator for mt4 download freebest forex market profile mt4 download freedownload best harmonic. Dapatkan akun demo di sini. The bull flag pattern starts with a bullish trend called a flag pole, which suddenly turns into a correction inside a bearish or a horizontal channel.

Gain capital uk ltd is a company incorporated in england and wales with uk companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, e1w 1jp. Sebelum memulai, ada baiknya jika anda memiliki akun demo forex terlebih dahulu agar anda bisa dengan mudah memahami pola yang ada dengan cara membandingkannya secara langsung. Quasimodo pattern is also called as over & under pattern.

Harmonic pattern indicator is a forex trading oscillator who can be work for mt4 trading platform, this is a comprehensive indicator who can be come for short and long terms as well. Please note that some patterns should be confirmed with the price, for example a pattern may be valid only if occurs during an uptrend or a downtrend. In this lesson, we covered six chart patterns that give reversal signals.

Forex calculators position size calculator pip calculator margin calculator. Depending on the direction of the movement, pennant patterns are usually. It is one of the most reliable and powerful patterns to trade.

This disqualifies the price structure from being traded as a head and shoulders pattern. Forex.com is a trading name of gain capital uk limited. Conversely, if a reversal chart pattern is seen during a downtrend, it suggests that the price will move up later on.

The pattern is negated if the price breaks below the upward sloping trendline. Forex triangle pattern indicator is a meta trader indicator that is uncommonly produced for the forex trading framework and it is extremely useful for the forex trading framework. Then if the price breaks the upper level of the channel, we confirm the authenticity of the flag pattern, and we have.

A bearish harami is a bearish reversal pattern that is most useful when found at the top of a bullish trend. Using reversal candlestick patterns in forex correctly can have a noticeable positive impact on a trader’s performance. Methods of a wall street master.

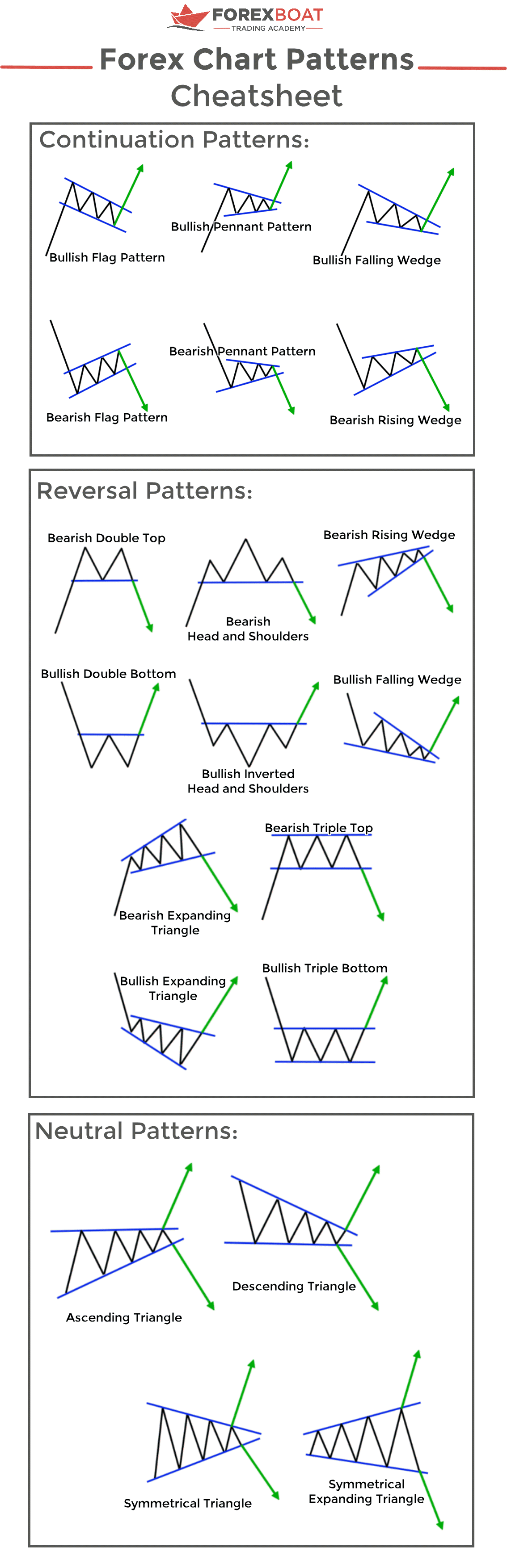

This is one of the significant reasons this pattern can make you profit every day. In other words, they simply measure out the distance in pips and then set a pending order to book profits at that level. Like we promised, here’s a neat little cheat sheet to help you remember all those chart patterns and what they are signaling.

Forex trading patterns are divided in groups based on the potential price direction of the pattern. What is quasimodo pattern in forex? The pattern looks like a small symmetrical triangle called a pennant, which is made up of numerous forex candlesticks.

The patterns themselves are quite simple and are formed when they display the open, high, low, and closed of a given trading period. The confirmation of the pattern is the break of the neckline after the formation of the double bottom a and b. A double bottom pattern is a bullish reversal pattern;

This indicator is utilized to identify the triangles pattern in the forex market that shows up because of the value activity changes of the forex currency pairs. Forex chart patterns, which include the head and shoulders as well as triangles, provide entries, stops and profit targets in a pattern that can be easily seen. Trading success is all about following your trading rules.

The forex head & shoulders pattern can develop over virtually any timeframe. Thus, forex traders tend to identify chart patterns in order to take advantage of upcoming price swings. 3# pin bar and awesome.

We’ve listed the basic forex chart patterns, when they are formed, what type of signal they give, and what the next likely price move may be. It is a reversal pattern that is created after a significant obvious trend. Stops can be placed at the swing low of bottom b and profits can be booked at.

I am going to show you everything you need to know to make money from this reversal pattern. Bagi anda yang sudah lama ataupun masih baru berkutat dalam dunia trading,. If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon.

It is the opposite of the double top pattern and is often traded by new and advanced forex traders. The flag chart pattern has a continuation potential on the forex chart. Learn about 12 common foreign exchange trading patterns and test your knowledge to see if you can accurately predict how each pattern plays out.

If you don’t know what’s a candlestick pattern, you can refer to our comprehensive forex technical analysis tutorial. Each chart pattern has the potential to push the price toward a new move. Today, the method of candlestick pattern analysis has evolved to become one of the most commonly used technical analysis tools in the forex market.

Questions i often get is about entries, objective exits, and stop losses. And key to spotting trend reversal in forex or confirm a trade. It is obviously not a secret since sperandeo’s book was published in 1993, but somehow traders tend to forget this one.

As the forex markets feature less gaps than equities, this pattern is less prominent and worth less of your time analysing as a result.

What Are The Most Frequently Used Forex Chart Patterns?

What Are The Most Frequently Used Forex Chart Patterns?

The Forex Chart Patterns Guide (with Live Examples

The Forex Chart Patterns Guide (with Live Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg) Most Commonly Used Forex Chart Patterns

Most Commonly Used Forex Chart Patterns

Types of Chart Patterns for Binary Options Trading

10 Best images about Trading patterns on Pinterest

10 Best images about Trading patterns on Pinterest

What is the best candlestick pattern for trading Forex

Trading infographic There are many Forex Chart patterns

Trading infographic There are many Forex Chart patterns

bat pattern forex Google Search ForexBasics Bat

bat pattern forex Google Search ForexBasics Bat

Forex Chart Patterns Cheat Sheet

Forex Chart Patterns Cheat Sheet

The 5 Most Popular Forex Chart Patterns Blackwell Global

The 5 Most Popular Forex Chart Patterns Blackwell Global

Forex Repeating Patterns Forex News Ea Free

Forex Repeating Patterns Forex News Ea Free

forex trends Archives Sir Forex

forex trends Archives Sir Forex

Forex Chart Patterns, Improve Your Trading Forexearlywarning

Introduction to harmonic price patterns. investingchef

Introduction to harmonic price patterns. investingchef

Nonstandard Forex patterns special view on habitual

Reversal models in the forex market ForeX Technical

Reversal models in the forex market ForeX Technical

Forex Trading Introduction of Harmonic Patterns Forex

Forex Trading Introduction of Harmonic Patterns Forex

What are Some Frequently Used Forex Chart Patterns

What are Some Frequently Used Forex Chart Patterns

Forex Friend Loan September 2017

Forex Friend Loan September 2017

Comments

Post a Comment